About two months ago I was having a discussion with a senior executive from a world class animation studio about Avatar, James Cameron's blockbuster movie which has grossed over $2.7 billion worldwide, since May 19, 2010. Depending on whom you believe, Avatar cost between $250 and $500 million to create, and my friend said, "I love the movie. I'm not sure how I feel about the fact that Cameron has just raised the price of building a leading edge movie to 1/2 a billion dollars!"

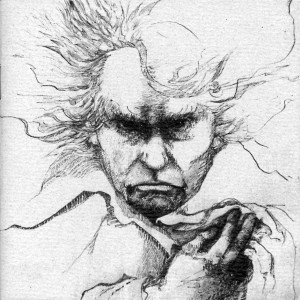

It turns out that Mozart, Beethoven, and other artists had a notion of the threshold pledge system, in which the artist would create a work after they were assured of a reasonable funding from the future audience. For this early pledge, the audience had access to a "scarce good" -- such as a concert by the artist. Given the rising cost of some of the leading edge digital experiences it seems to me it's time to resurrect the Mozart model.

It is obvious that a proven artist like James Cameron could ask his audience to crowdfund a new film. Put another way, how many millions of people would be willing to pay $50 for a first run movie ticket plus a t-shirt for Avatar II, whenever it comes out. Let's assume that Cameron can only collect $100,000,000 of a $500,000,000 budget for his next visionary piece. The next $400,000,000 million has much less risk because the investors already know that 2,000,000 people are ready to enter the theater. Not only is the funding in place, but the investors know that the marketing risk is vastly lowered due to the fact that the audience has already pre-committed to attend!

Of course in today's financial world, with many sophisticated charlatans, and a host of financial regulators, we may need some innovations in contracting to allow the retail audience to fund a future creative act. I don't see any snags now, but if firms start raising $100,000,000 in this manner we may find new ways that crooks enter this process and we may need new mechanisms to keep out the bad guys, while keeping risk reasonable for institutional money. Nevertheless, it seems to me that with the increasing availability of social networks like Facebook and LinkedIn, and cooperative financing infrastructures like Indie Go Go, we may see a whole new set of mutualization of risk -- as it concerns intellectual property innovation.

I hope this comes to pass, as it will help artistic variety flourish.